When you’ve attained this short article, it’s a simple process of going into the required guidance to your Pepper Money Credit Energy Calculator. For example, you can have a good $1 million put saved up, but one doesn’t suggest you could potentially manage to meet the attention money for the a great multiple-million-dollar home loan. Credit strength, but not, talks about the quantity you might borrow, and also the assets values you could manage considering how much you might subscribe to mortgage payments. Which have a lot fewer or straight down a fantastic expenses, loan providers notice you have additional money in order to provider your own home loan – and could probably enhance your borrowing from the bank energy consequently. The people compensate all of us to own advertising that appear to the our very own site.

What type of upfront costs are there?

ˇ A keen an indicator interest and projected repayments aren’t a official acceptance for a loan, thus wear’t go into one financial responsibilities according to they.

He could be techniques simply, in line with the basic suggestions your provide and also the credit score we get to the first application that is perhaps not a recommendation or recommendation of every mortgage device. An estimate of the borrowing from the bank energy makes it possible to recognize how much money you might borrow. So, remain you to definitely more step three% in mind once you’re also thinking about borrowing from the bank energy. A certain mortgage unit may sound in your setting based on your need loan amount, exactly what if the their said speed try step three% highest? Our mortgage assessment equipment will need that it barrier into consideration whenever figuring their borrowing energy.

Interest levels referenced try newest rates according to Prominent and Interest money. That it preference are linked with the mortgage-to-really worth proportion (LVR), which is crucial for determining your own credit power. LVR are computed from the separating the mortgage amount from the property’s really worth. Less LVR mode you have a smaller sized financing than the the brand new property’s well worth, and therefore decreases chance for lenders.

We are really not providing you with an advice or suggestion from the a specific mortgage. You should read the associated disclosure statements or any other provide files before deciding whether or not to apply for otherwise continue using a kind of unit. To have homeowners, the brand new security on your latest property might be leveraged so you can safer more credit.

Lenders tend to evaluate your own complete earnings after income tax to check on their power to services the borrowed funds (we.elizabeth. generate repayments). Large money generally leads to an elevated borrowing from the bank capability. We strive to cover a general range of products, team, and you may services; although not, we really do not security the complete business. Items in all of our assessment tables try sorted according to some issues, in addition to tool provides, interest levels, charge, dominance, and you will commercial agreements. Estimate home loan expenditures such mortgage applications, monthly payments, possessions government and more.

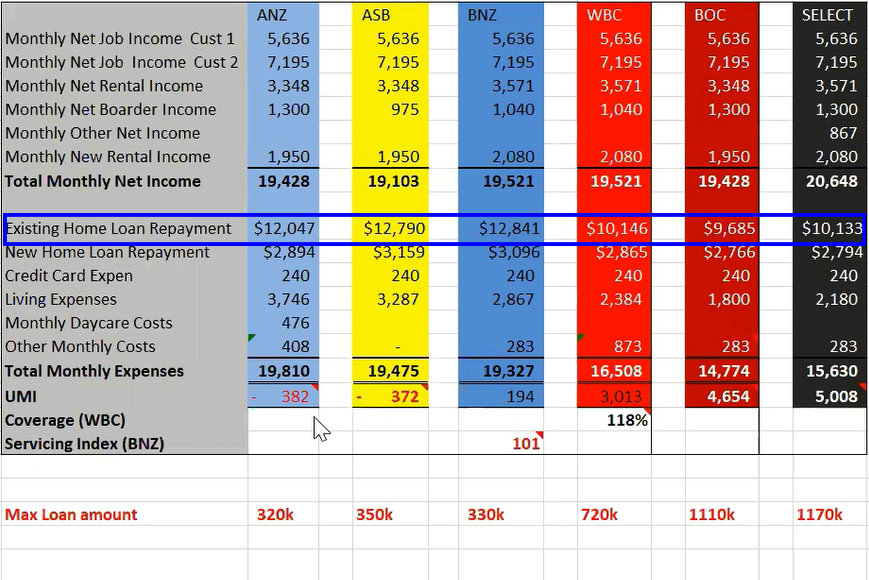

For each financial recommendations your financial situation differently, in addition to their financing slash-from values and you may acceptance standards may vary widely. Sure, HECS loans can aid in reducing your credit power because the repayments lower your disposable income while increasing the debt-to-earnings ratio, which lenders used to regulate how far you could use. Sure, using which have someone can increase their credit electricity because your shared earnings is higher as well as your full budget is healthier.

Their expenses

Check your credit rating online and when it’s lowest, perform what you can to change it. You’ll find out all you need to learn about repairing the credit history here. Loan providers as well as want to see that you could save, because it reveals what you can do to place currency away to provider the loan. Many home loan calculators can give you a principle and you may interest calculation.

- Our financial qualifications calculator crunches the new amounts helping you contour from financial count you might qualify for.

- Yet not, lenders will also determine each of your debts and borrowing from the bank histories, that can affect the result.

- Provides a read ones 5 steps of having property mortgage, you’re also one-step ahead when you’ve receive the right spot to shop for.

- Whenever a lender investigates your own mortgage app it takes into account your own mortgage size, deposit, earnings, and you can issues just like your costs and you may spending designs in order to anticipate the borrowing energy.

Rates and you will device information will be affirmed for the relevant credit supplier. For more information, read YourMortgage.com.au’s Monetary Features and you can Borrowing from the bank Publication (FSCG). As the 1995 we’ve been permitting Australians find out about owning a home, compare home loans and have help from financial professionals to find the appropriate mortgage for them.

- Our very own pre-acceptance lasts for ninety days that is fully borrowing reviewed.

- You’ll in addition need a lot more savings to satisfy possessions transaction will set you back such solicitor/conveyancer charge, stamp duty or any other charges.

- Thus, remain one to extra step 3% in your mind once you’lso are contemplating credit power.

In contrast, increased rate expands money, which can lower your credit energy. Yes, that have a great guarantor on your financial you are going to will let you obtain more income to buy a property. The fresh guarantor agrees to cover specific or your entire mortgage money if you can’t, getting additional shelter you to definitely reduces the bank’s chance, which makes them hotter giving a larger amount borrowed. Their credit electricity is when far a loan provider decides you can borrow. Whenever a loan provider discusses their home loan application it considers the financing dimensions, put, earnings, and you may items such as your bills and paying designs to help you prediction their borrowing energy.

Tips create a credit score register Australian continent

The most vital loans to settle earliest try high-desire expenses for example handmade cards otherwise signature loans. Taking good care of people focus-totally free financial obligation, including student education loans, isn’t important here; it will be more impactful to use which more income to save a lot more to own a deposit. Just remember that , the interest cost on the calculator are susceptible to change, that can impact on installment numbers.

The rate will be based upon all of our current Qudos mortgage rate. Beyond figuring your guess credit electricity, you can study more about your future payments with this borrowing from the bank financial hand calculators and you may newest mortgage rates. There is a large number of different aspects which go to your figuring simply how much you might borrow to possess a mortgage.

Name import payment

Start by entering your property’s facts observe their prospective borrowing line. Height up your financial training, to make to purchase & credit behavior centered on unbiased items. Stephen have over 30 years of expertise in the financial functions community and you will holds a certificate IV inside Money and you will Mortgage Broking. He’s as well as an associate out of both the Australian and you may The newest Zealand Institute away from Insurance policies and Financing (ANZIIF) plus the Financial and you can Financing Connection away from Australia (MFAA). Principal component of a hypothetical home loan and you may, you guessed it, less borrowing energy.

Our house financing hand calculators and you will systems try here in order to of your home financing thought. You can find out how much you can obtain, imagine your repayments to make exactly how much you really need to have in initial deposit. Most other important info+Tiimely House is known for its punctual approvals to own Tiimely Own products and responsive services, powered by our very own tech and supported by all of us out of benefits. Software and you will acceptance times try prices only rather than protected. Programs to possess a Tiimely Own financing might need an enthusiastic assessor to help you see more information. Research times to have home loan programs generated thru Tiimely House agents try influenced by personal panel loan providers.

Guide within the a chat with one of our friendly pros, or start applying online and we’re going to get into touching. Take a look at what you can afford to pay back for the a mortgage with your Value Calculator otherwise imagine exactly how much you can acquire with your Restriction Online calculator. Contact your financial, your financial mentor, and/or a property specialist for guidance or suggestions regarding your specific condition.